Singapore’s real estate market stands out globally for its resilience and consistent performance. Despite global economic fluctuations, the city-state’s property sector continues to demonstrate long-term strength. This stability is built on a solid economic foundation supported by government policy, investor confidence, and strategic urban planning.

1. Strong Economic Fundamentals and Policy Framework

Coastal Cabana represents how Singapore’s economic structure supports real estate growth. The country’s stable GDP, low unemployment, and robust financial systems create an environment where property investment remains attractive and sustainable. The government’s commitment to fiscal prudence and transparency has long assured both local and foreign buyers of predictable conditions.

Monetary stability, supported by careful regulation of lending and interest rates, prevents excessive market speculation. This disciplined approach has helped Singapore avoid the property bubbles seen in other global cities. In turn, developers and investors can plan confidently, knowing that government oversight ensures market balance.

As a result, Singapore’s property sector remains one of the most trusted in Asia, offering consistent long-term value and resilience even during uncertain times.

2. Infrastructure, Urban Planning, and Sustainable Growth

The city’s well-planned infrastructure plays a central role in maintaining property stability. Projects such as the expansion of MRT lines, new business districts, and integrated housing developments ensure balanced urban growth across the island. This coordinated planning prevents over-concentration and supports equitable value appreciation across different regions.

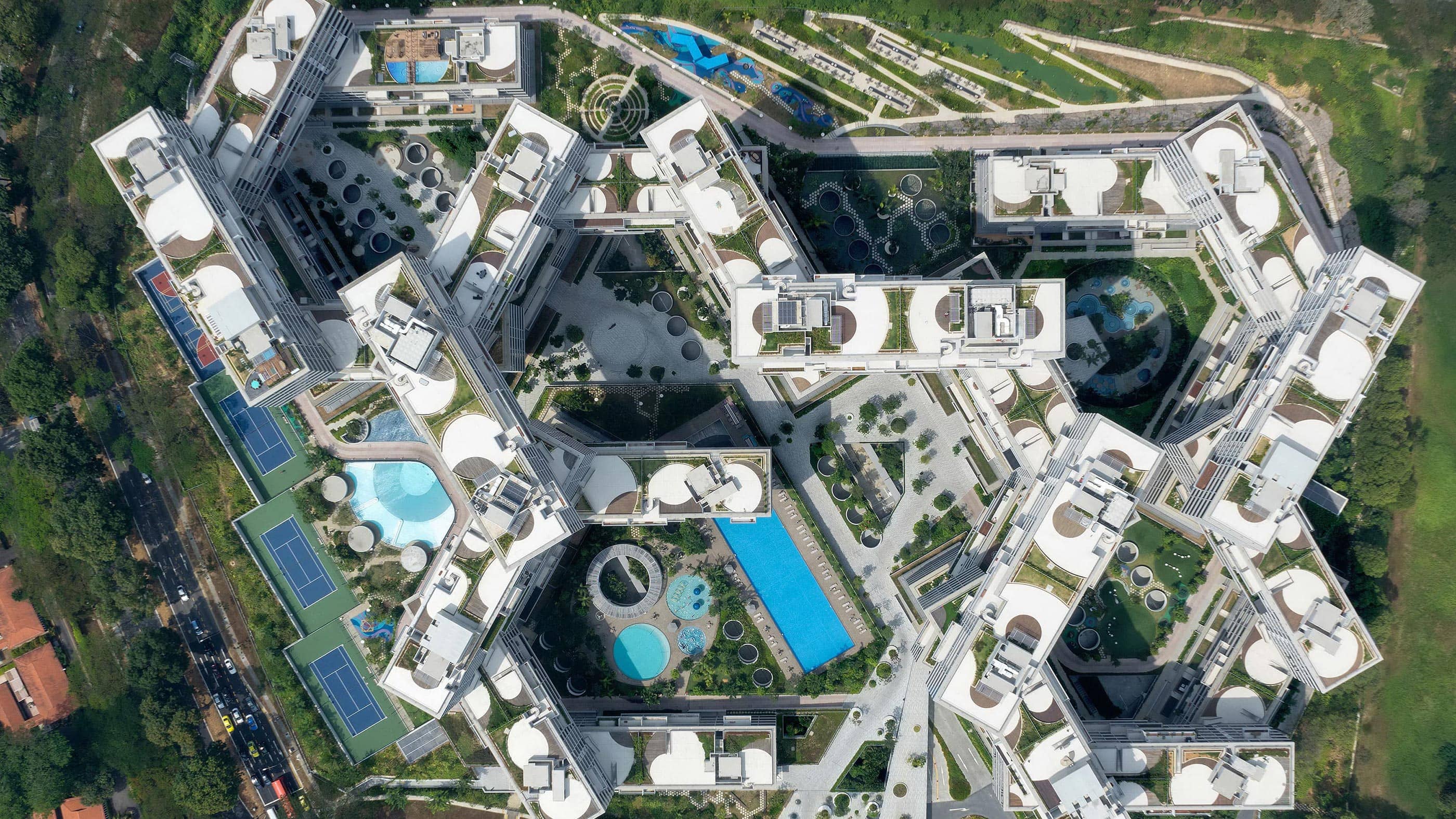

Developments like Coastal Cabana benefit from these efforts by aligning with the government’s vision of sustainable urban living. Green spaces, smart city technology, and energy-efficient systems enhance livability while supporting environmental goals. Such initiatives strengthen public trust and attract long-term investors seeking security and quality in their assets.

Singapore’s real estate framework integrates economic planning with social stability, ensuring that development benefits the broader community while maintaining market confidence.

3. Investor Confidence and Global Positioning

Singapore’s global reputation as a safe and transparent investment hub further anchors its real estate stability. The nation’s strong legal system protects property rights, while clear ownership laws provide assurance to both domestic and international buyers. This reliability is a key factor driving sustained demand from institutional investors and high-net-worth individuals.

Foreign investors also view Singapore’s property market as a hedge against regional volatility. Strategic location, strong infrastructure, and a pro-business environment position the country as a leading gateway for global capital seeking long-term returns.

Even during global downturns, Singapore’s reputation for sound governance and economic resilience ensures that property values remain stable and recover swiftly once market conditions improve.

Conclusion

Singapore’s real estate stability is rooted in disciplined governance, economic foresight, and world-class urban planning. These elements work together to create a balanced market capable of sustaining growth through global shifts and local challenges.

Developments like Coastal Cabana exemplify the results of this solid foundation—projects built with sustainability, confidence, and long-term value in mind. As Singapore continues to evolve, its real estate market will remain a model of economic strength and enduring stability.